Cryptocurrency definition

Various studies have found that crypto-trading is rife with wash trading. Wash trading is a process, illegal in some jurisdictions, involving buyers and sellers being the same person or group, and may be used to manipulate the price of a cryptocurrency or inflate volume artificially. different genres of poetry Exchanges with higher volumes can demand higher premiums from token issuers. A study from 2019 concluded that up to 80% of trades on unregulated cryptocurrency exchanges could be wash trades. A 2019 report by Bitwise Asset Management claimed that 95% of all bitcoin trading volume reported on major website CoinMarketCap had been artificially generated, and of 81 exchanges studied, only 10 provided legitimate volume figures.

Properties of cryptocurrencies gave them popularity in applications such as a safe haven in banking crises and means of payment, which also led to the cryptocurrency use in controversial settings in the form of online black markets, such as Silk Road. The original Silk Road was shut down in October 2013 and there have been two more versions in use since then. In the year following the initial shutdown of Silk Road, the number of prominent dark markets increased from four to twelve, while the amount of drug listings increased from 18,000 to 32,000.

On 13 September 2018, Homero Josh Garza was sentenced to 21 months of imprisonment, followed by three years of supervised release. Garza had founded the cryptocurrency startups GAW Miners and ZenMiner in 2014, acknowledged in a plea agreement that the companies were part of a pyramid scheme, and pleaded guilty to wire fraud in 2015. The SEC separately brought a civil enforcement action in the US against Garza, who was eventually ordered to pay a judgment of $9.1 million plus $700,000 in interest. The SEC’s complaint stated that Garza, through his companies, had fraudulently sold “investment contracts representing shares in the profits they claimed would be generated” from mining.

In May 2018, Bitcoin Gold had its transactions hijacked and abused by unknown hackers. Exchanges lost an estimated $18m and bitcoin Gold was delisted from Bittrex after it refused to pay its share of the damages.

On 18 May 2021, China banned financial institutions and payment companies from being able to provide cryptocurrency transaction related services. This led to a sharp fall in the price of the biggest proof of work cryptocurrencies. For instance, bitcoin fell 31%, Ethereum fell 44%, Binance Coin fell 32% and Dogecoin fell 30%. Proof of work mining was the next focus, with regulators in popular mining regions citing the use of electricity generated from highly polluting sources such as coal to create bitcoin and Ethereum.

Newest cryptocurrency

Congestion on the largest smart contract-enabled blockchain sent users in search of more scalable blockchains, spurring the growth of alternative layer 1 blockchains and scaling tools. The year brought astronomical gains for the likes of Avalance, Fantom, Polygon and Terra, which ate up half the slots in the top 10.

Additionally, the unfortunate reality is that some cryptocurrencies are nothing more than scams, launched in a matter of minutes via the processes described above. Founders hope they can make a quick buck while hiding behind the anonymity of the blockchain.

The total crypto market volume over the last 24 hours is $226.6B, which makes a 24.59% decrease. The total volume in DeFi is currently $9.37B, 4.14% of the total crypto market 24-hour volume. The volume of all stable coins is now $210.31B, which is 92.81% of the total crypto market 24-hour volume.

Congestion on the largest smart contract-enabled blockchain sent users in search of more scalable blockchains, spurring the growth of alternative layer 1 blockchains and scaling tools. The year brought astronomical gains for the likes of Avalance, Fantom, Polygon and Terra, which ate up half the slots in the top 10.

Additionally, the unfortunate reality is that some cryptocurrencies are nothing more than scams, launched in a matter of minutes via the processes described above. Founders hope they can make a quick buck while hiding behind the anonymity of the blockchain.

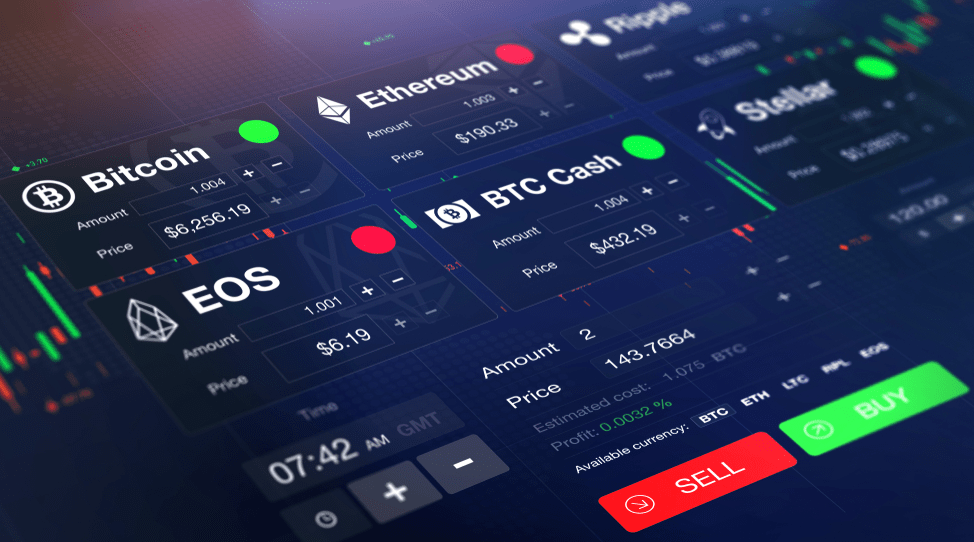

Cryptocurrency exchange

Their per-trade fees are quite good, though they do charge withdrawal fees unlike some other exchanges in this list, and because they are relatively new it’s impossible to give them a truly solid score on reputation and security, as they haven’t been around long enough yet to really be battle tested.

Passive yield wise, Coinbase offers in-house staking of a handful of coins, with no lockup times, though they do take a reasonably high cut of the rewards in the process (~25% of the staking rewards).

I’ve seen other people saying that both Coinbase and Binance are generally ok for small amounts, and I’m reasonably new to crypto and don’t have the cash to invest loads, so maybe Coinbase or Binance would be fine for me, but every time I read another post about the issues people have had, it makes me nervous!

Their per-trade fees are quite good, though they do charge withdrawal fees unlike some other exchanges in this list, and because they are relatively new it’s impossible to give them a truly solid score on reputation and security, as they haven’t been around long enough yet to really be battle tested.

Passive yield wise, Coinbase offers in-house staking of a handful of coins, with no lockup times, though they do take a reasonably high cut of the rewards in the process (~25% of the staking rewards).

I’ve seen other people saying that both Coinbase and Binance are generally ok for small amounts, and I’m reasonably new to crypto and don’t have the cash to invest loads, so maybe Coinbase or Binance would be fine for me, but every time I read another post about the issues people have had, it makes me nervous!